Are you a freelancer, independent contractor, or gig worker? Then Working for Yourself: Law & Taxes for Independent Contractors, Freelancers & Gig Workers of All Types by Stephen Fishman, J.D., is your essential guide. This comprehensive resource consolidates all the crucial legal and tax information you need, eliminating the need for endless online searches. From choosing the optimal business structure (sole proprietor, LLC, etc.) to mastering tax deductions and credits – including the 20% pass-through deduction and new EV credits – this updated edition provides practical advice. Learn how to manage payments, estimated taxes, insurance, record-keeping for audits, and even crafting legally sound contracts. Take control of your financial future and confidently navigate the complexities of self-employment.

Review Working for Yourself

Let me tell you, "Working for Yourself: Law & Taxes for Independent Contractors, Freelancers & Gig Workers of All Types" by Stephen Fishman, J.D., is a lifesaver! I was initially hesitant to dive into the world of self-employment, mostly because of the overwhelming legal and tax jargon. The thought of navigating all those regulations on my own was pretty daunting, to say the least. But this book? It’s like having a friendly, knowledgeable accountant and lawyer sitting right beside me, guiding me through every step.

What I truly appreciate is how comprehensive it is. It doesn't shy away from the complexities of choosing the right business structure – sole proprietor, LLC, and the rest – explaining the pros and cons of each in clear, easy-to-understand language. No more endless, frustrating Google searches for me! Fishman breaks down the often-confusing world of taxes, making it manageable and even… dare I say… interesting? He explains how to pay estimated taxes to avoid penalties, and, even better, how to take advantage of all those available tax deductions and credits. Seriously, the section on the 20% pass-through tax deduction alone is worth the price of the book. The updated information on Section 179 expensing and bonus depreciation was also incredibly helpful, especially given the recent changes in tax law. The addition of the electric vehicle tax credits section is a welcome and timely inclusion, too.

Beyond the tax side, the book covers crucial legal aspects, walking you through creating legally binding contracts and letter agreements. This is something I really needed help with, and the book makes it feel approachable and achievable. It also touches upon essential topics like choosing the right insurance and keeping accurate records – you know, the stuff that can really save you from headaches (and potential audits) down the line. The advice on requesting payment on time is invaluable – something I learned the hard way before finding this book!

The writing style itself is incredibly approachable. It’s not dense or overly technical; Fishman manages to explain complex concepts in a way that's digestible even for someone like me, who isn't an accountant or lawyer. It's the perfect resource for both beginners who are just starting out and those who are a bit more experienced but want a comprehensive guide to ensure they are doing everything correctly. This is not just a book to read once and shelve; it's a reference guide that I frequently consult, a reliable companion in my self-employment journey. It's filled with extensive information, yet organized in a way that makes finding what you need quick and easy.

In short, if you're considering working for yourself, or if you're already doing it and feeling overwhelmed, this book is an absolute must-have. It's saved me countless hours of research and worry, and has provided me with the confidence to navigate the often-tricky waters of independent work. Highly, highly recommended.

Information

- Dimensions: 7 x 1 x 9 inches

- Language: English

- Print length: 544

- Publication date: 2024

- Publisher: NOLO

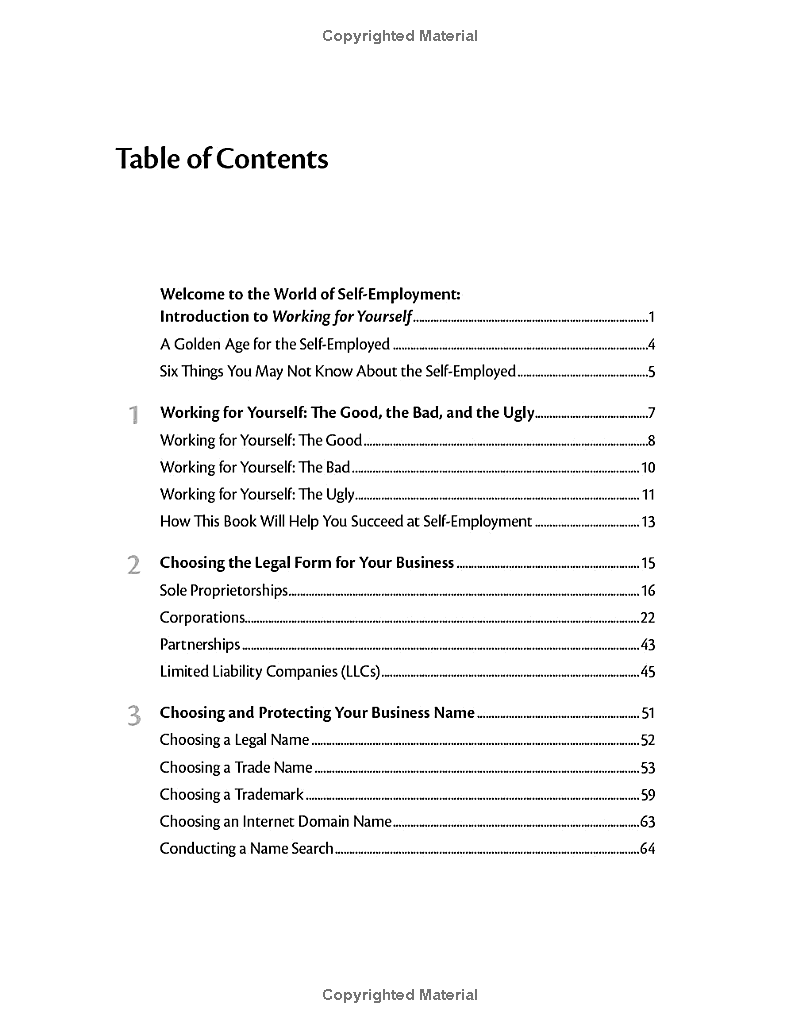

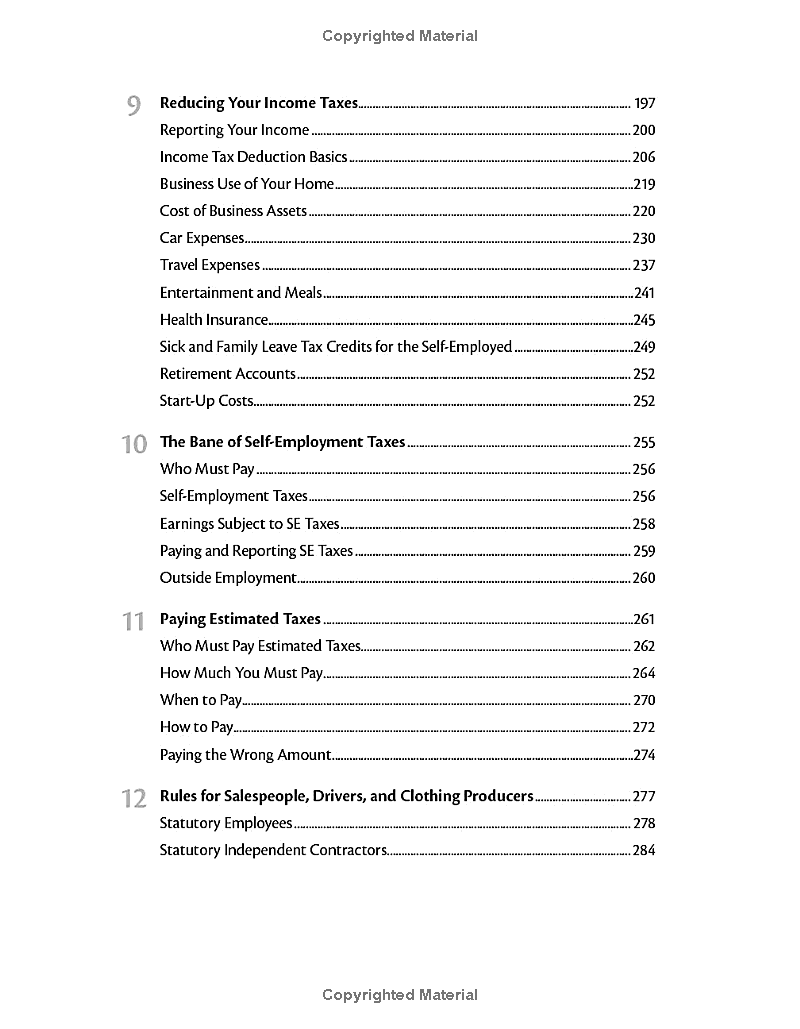

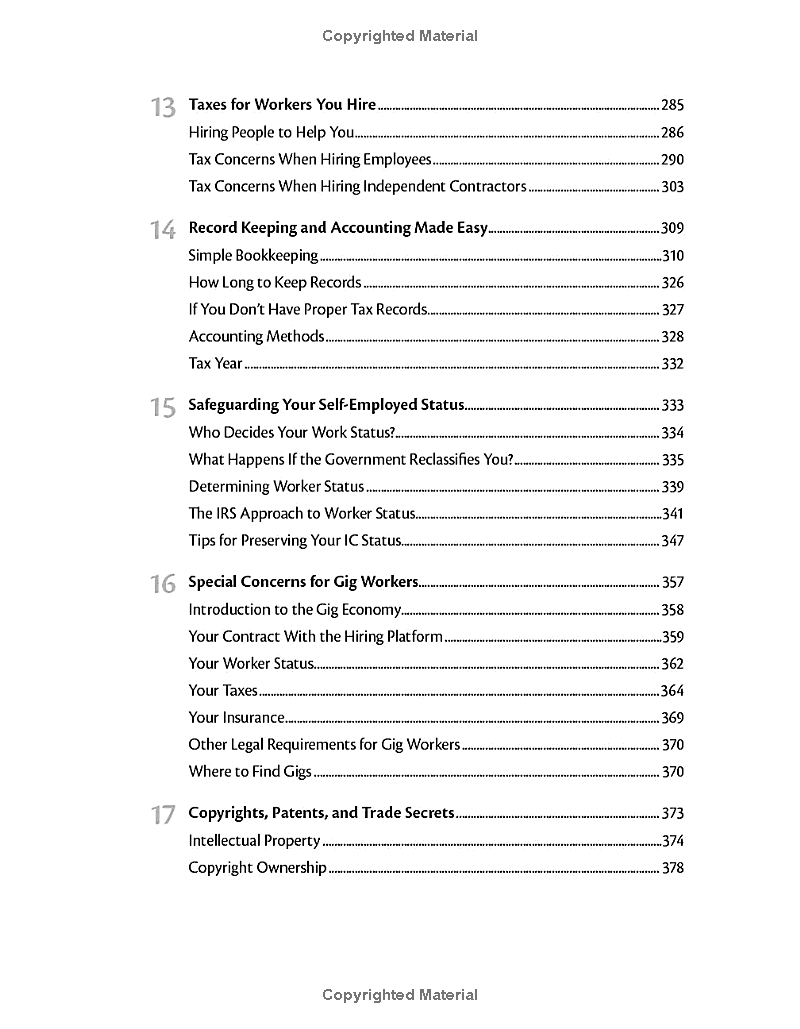

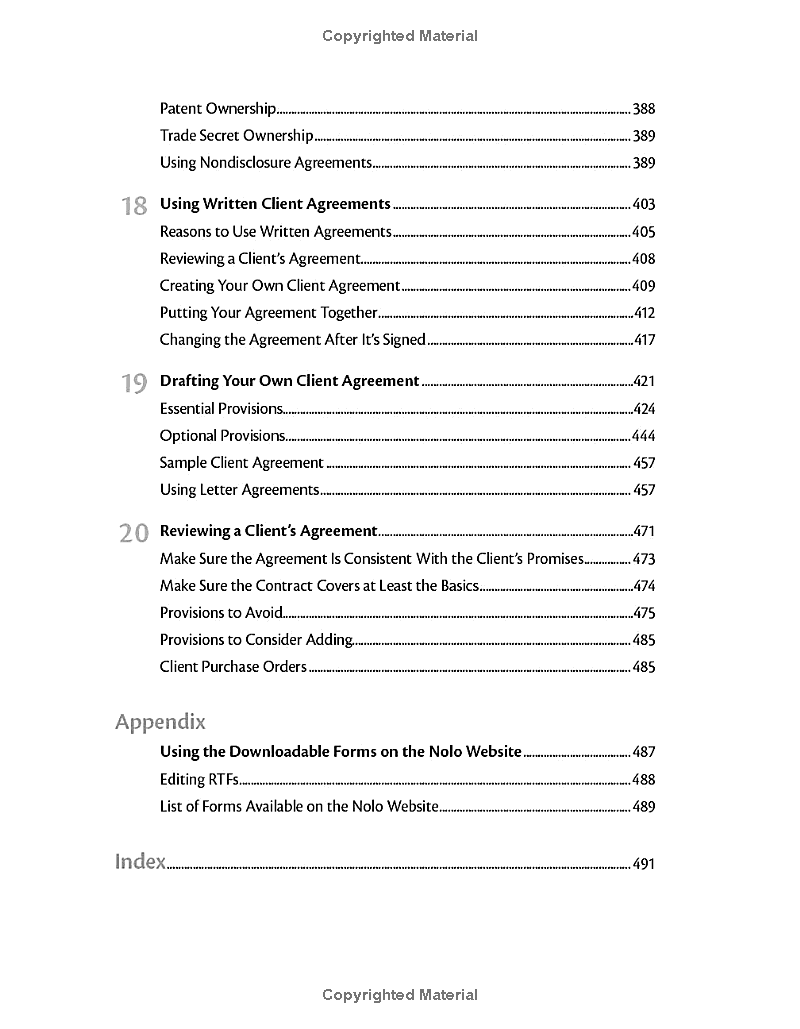

Book table of contents

- Welcome to the World of Self-Employment:

- Choosing the Legal Form for Your Business

- Choosing and Protecting Your Business Name

- Home Alone or Outside Office

- Obtaining Licenses, Permits, and Identification Numbers

- Insuring Your Business and Yourself

- Your Services and Getting Paid

- Taxes and the Self-Employed

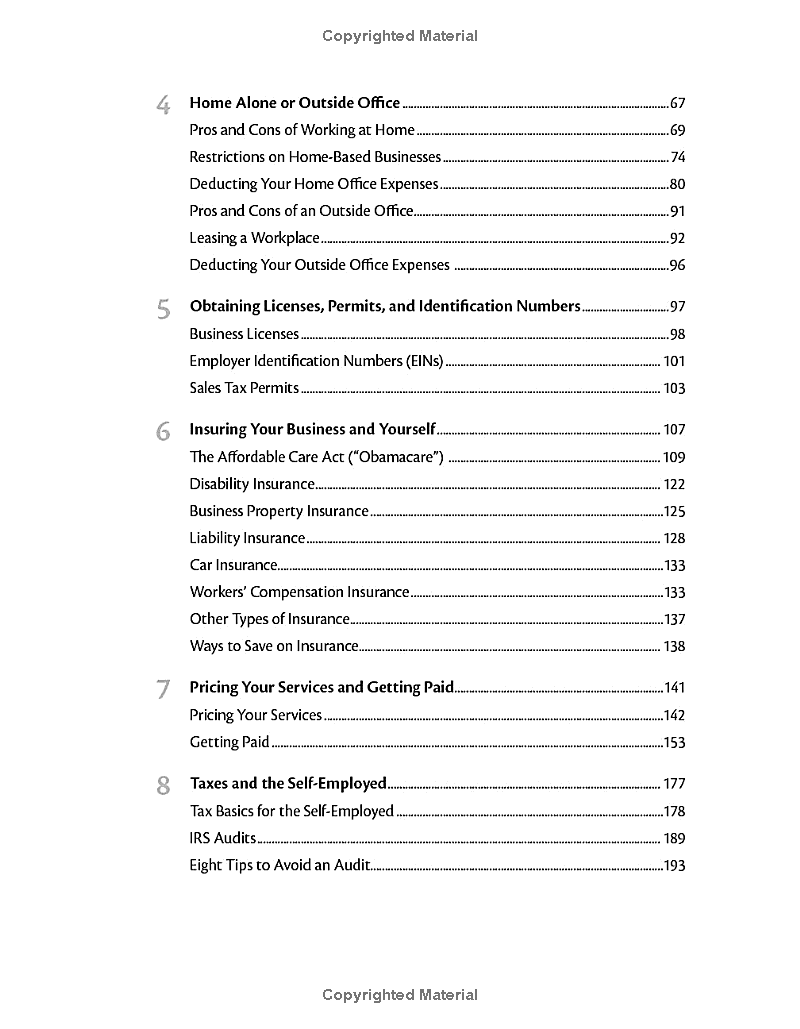

- Patent Ownership

- Trade Secret Ownership

- Using Nondisclosure Agreements

- Using Written Client Agreements

- Drafting Your Own Client Agreement

- Essential Provisions

- Optional Provisions

Preview Book